Solutions for PRIVATE EQUITY

Accelerate, Optimize, and Drive Alpha with AI

Processing 200+ documents per company? No problem. Kruncher is built for demanding PE workflows: Organize your data, triage companies smarter, generate custom IC case packs, all in one single source of truth.

Trusted by

Kruncher is made for PE

30+ Hyper-specialized AI Agents for PE tasksWe don't do generic. Our 30+ AI Agents highlight financial metrics, operational improvements, and exit opportunities.

30+ Hyper-specialized AI Agents for PE tasksWe don't do generic. Our 30+ AI Agents highlight financial metrics, operational improvements, and exit opportunities. Customized to your exact PE workflowCustomize everything in Kruncher based on your mandate. Integrate with your existing systems/CRMs so there's no workflow disruptions.

Customized to your exact PE workflowCustomize everything in Kruncher based on your mandate. Integrate with your existing systems/CRMs so there's no workflow disruptions. Automate every layer of your investment processFrom deal sourcing to exit planning, Kruncher's AI streamlines analysis so you can focus on value creation and strategic decision-making.

Automate every layer of your investment processFrom deal sourcing to exit planning, Kruncher's AI streamlines analysis so you can focus on value creation and strategic decision-making.

Kruncher for Data-Driven VCs

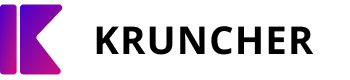

Layered Intelligence Architecture

Our unique 5-layer data approach builds on public data, adds premium research sources, incorporates internal materials by founders, and rounds it all with your team's values and judgment.

Kruncher’s analytical depth and accuracy is achieved due to our layered data methodology that creates the most complete company picture possible, building up a superior data foundation to enable superior investment decisions that competitors simply cannot match with standard tools.

This is a complete re-imagining of data collection and structurization that offers nuanced analysis, not just having Big Data.

Kruncher for Fund Intelligence

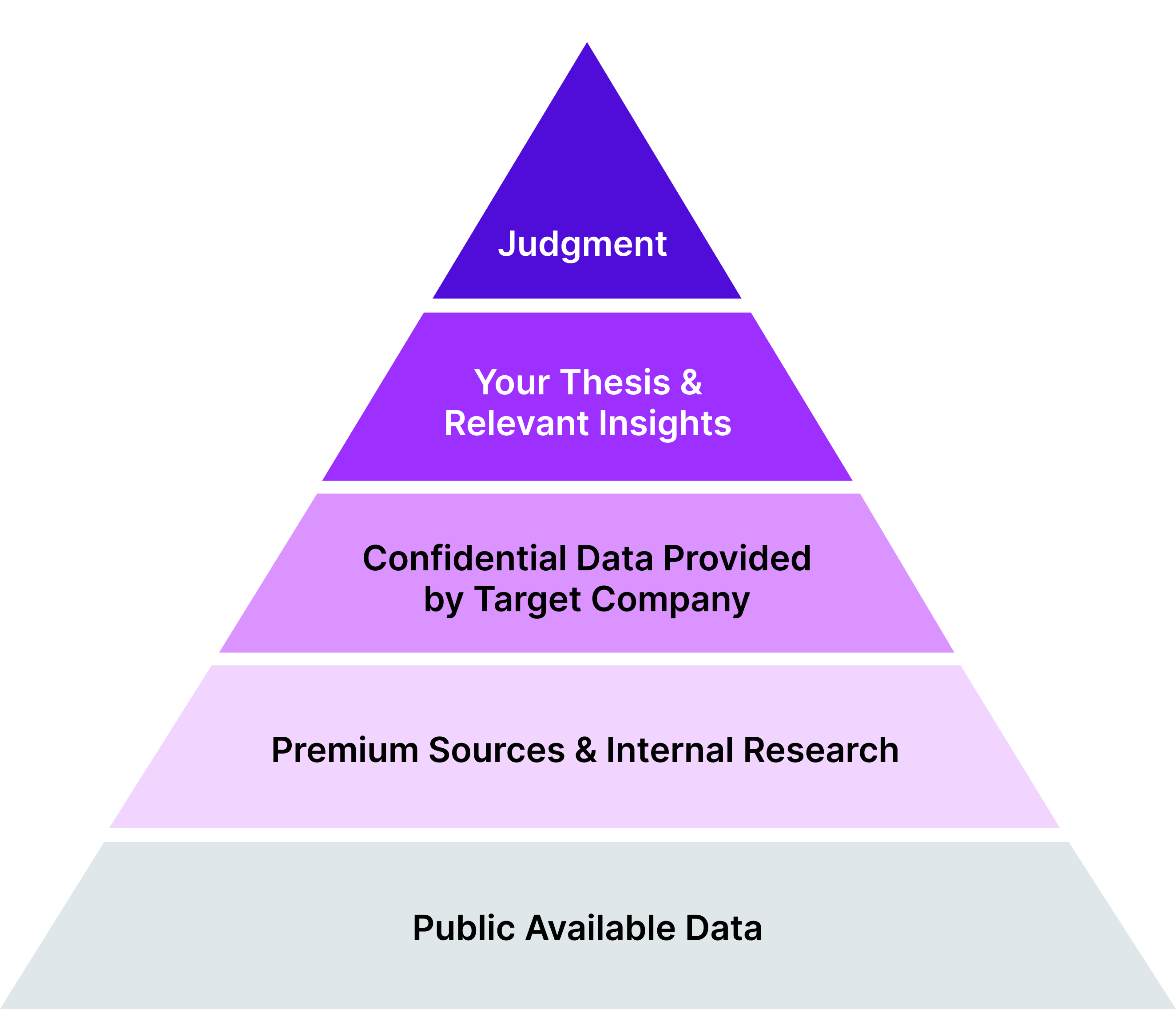

Centralized, Single Source of Truth

Say goodbye to hunting through 200+ documents scattered across emails, data rooms, consultant reports, and fragmented Excel files.

Consolidate different document formats and data sources into a centralized Intelligence Platform. Kruncher processes financial statements, legal docs, management presentations, and due diligence reports automatically.

Access complete company intelligence in seconds instead of hours spent on manual data entry, enabling faster decision-making with complete transparency across your deal team.

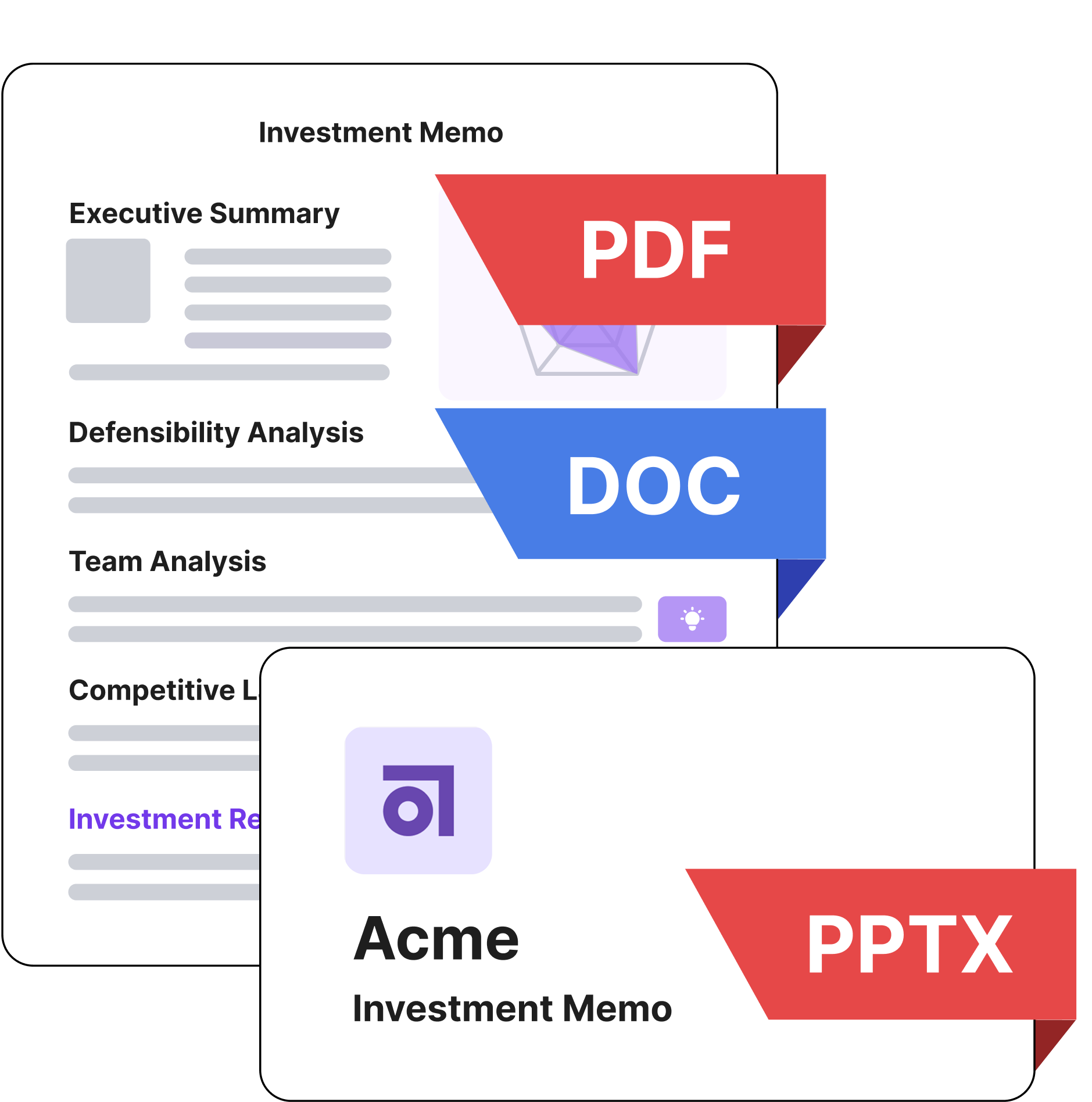

Custom IC Case Packs in one click

Kruncher for Faster PE processes

Create extensive reports and investment committee materials in minutes. Automate processes in your due diligence workflow and redirect time toward high-value operational improvements and strategic guidance.

Automate insights generation as Kruncher builds LOI packs with integrated comps, KPIs, and valuation ranges. It also maps exit pathways, tracks buyer activity, generates early disinvestment alerts.

From LOI to closing, enable comprehensive deal analysis at a fraction of traditional consulting costs and time spent while maintaining the depth your IC demands.

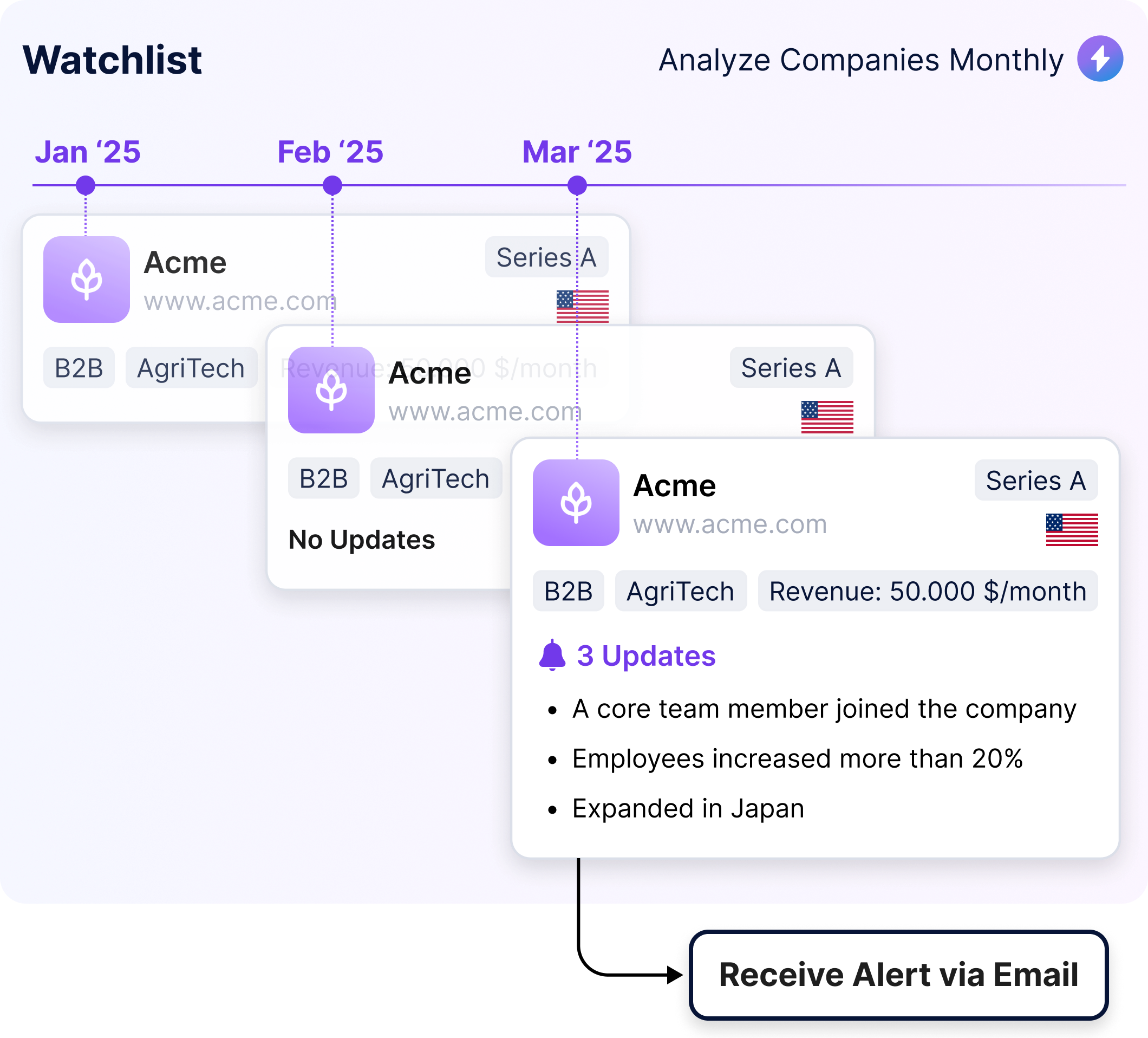

Kruncher for Watchlist Monitoring

Automatically Monitor Your Watchlist

Kruncher tracks 90+ KPIs across portfolio companies, automatically analyzing performance data, operational changes, market shifts, and exit signals that impact valuation and strategic direction.

Work smarter, not harder. Get alerts on critical performance metrics and market developments before they impact your portfolio company valuations or exit timing.

Get first-mover advantage on exit opportunities. Identify which companies are showing strong momentum and track market conditions to optimize exit timing and valuation.